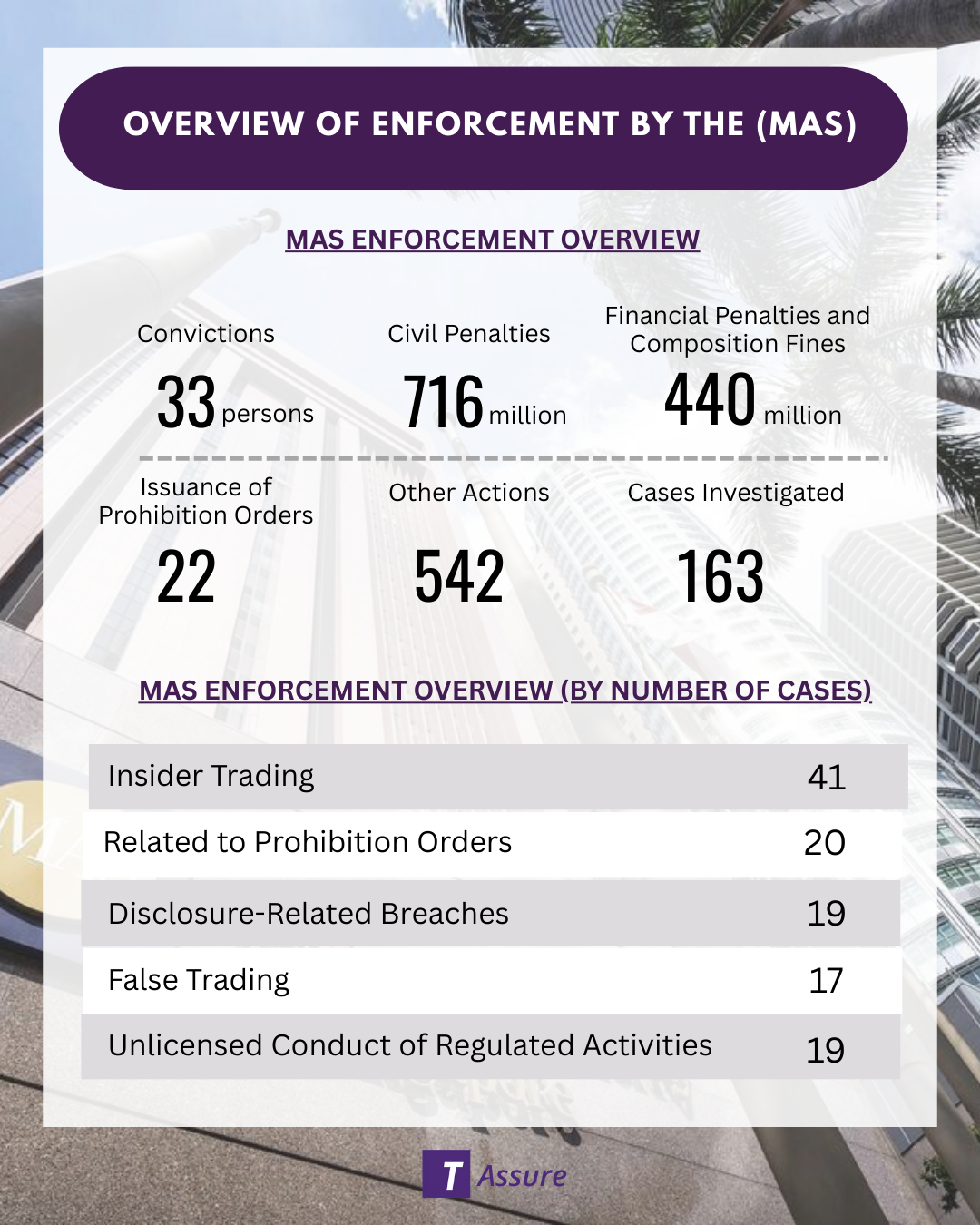

On 14 April 2024, the Monetary Authority of Singapore (MAS) released its fifth Enforcement Report, highlighting major enforcement actions between 1 July 2023 and 31 December 2024.

1. Total Penalties Imposed: S$11.56 Million

During the 18-month period, MAS imposed:

-

S$7.16 million in civil penalties

-

S$4.4 million in composition and financial penalties

2. 33 Individuals Convicted

Of the convicted individuals:

-

19 were sentenced to imprisonment

-

13 were fined

-

1 received both imprisonment and a fine

Offences included:

-

12 cases of false trading

-

9 disclosure breaches

-

6 instances of unlicensed regulated activities

-

5 fraud-related offences

-

1 prospectus violation

3. 542 Additional Supervisory Actions

MAS also took 542 non-court enforcement measures:

-

305 supervisory reminders

-

116 formal warnings

-

86 advisory letters

-

35 public reprimands

4. Key Case Developments

1. S$3 Billion Money Laundering Case: MAS is reviewing financial institutions’ AML/CFT lapses.

2. Eagle Hospitality Trust: The former CEO was charged; investigations into other directors continue.

3. Samtrade FX: MAS and the Attorney-General’s Chambers are reviewing findings from investigations.

5. Longer Case Resolution Times

The report noted that average processing time for criminal cases has increased due to growing complexity and cross-border cooperation needs.

6. Future Enforcement Focus

MAS will focus on:

-

Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT): Enhancing guidance, data sharing, and penalties

-

Digital Assets Oversight: Collaborating with regulators and tech providers to improve monitoring and investigation