Services Trade: The New Engine of Growth

According to the Ministry of Trade and Industry (MTI)’s Q1 2024 Economic Survey, Singapore’s services trade has become a major driving force of the national economy. From 2014 to 2024, Singapore’s services trade grew at an impressive compound annual growth rate (CAGR) of 9.4%, significantly outpacing the 6.2% growth in nominal GDP over the same period.

In particular, services exports expanded at a CAGR of 10.5%, while goods exports grew at a much slower pace of 2.5%. Over the decade, the total value of services exports surged by 171.3%, compared to a modest 28.2% growth in goods exports.

Rising Contribution to GDP

The ratio of services trade to nominal GDP rose sharply from 101.8% in 2014 to 136.4% in 2024, highlighting the sector’s growing economic importance.

Additionally, the value-added contribution of services exports to GDP increased from 36.9% in 2014 to 39.1% by 2020, while the value-added from goods exports remained stable at around 24%.

Top Growth Drivers: Transport, Business, and Financial Services

The robust growth in services exports was primarily driven by three key sectors:

-

Transport Services (56 percentage points contribution)

-

Business-Related Services (54.2 percentage points)

-

Financial Services (23.1 percentage points)

Digital transformation is also playing a bigger role:

Telecommunications, computer and information services rose from 5.2% of services exports in 2014 to 7.8% in 2024, overtaking travel services, which declined from 12.5% to 6%, largely due to the COVID-19 pandemic.

Evolving Trade Landscape: China and Japan Rise in Importance

Singapore’s services trade network has diversified significantly over the past decade:

-

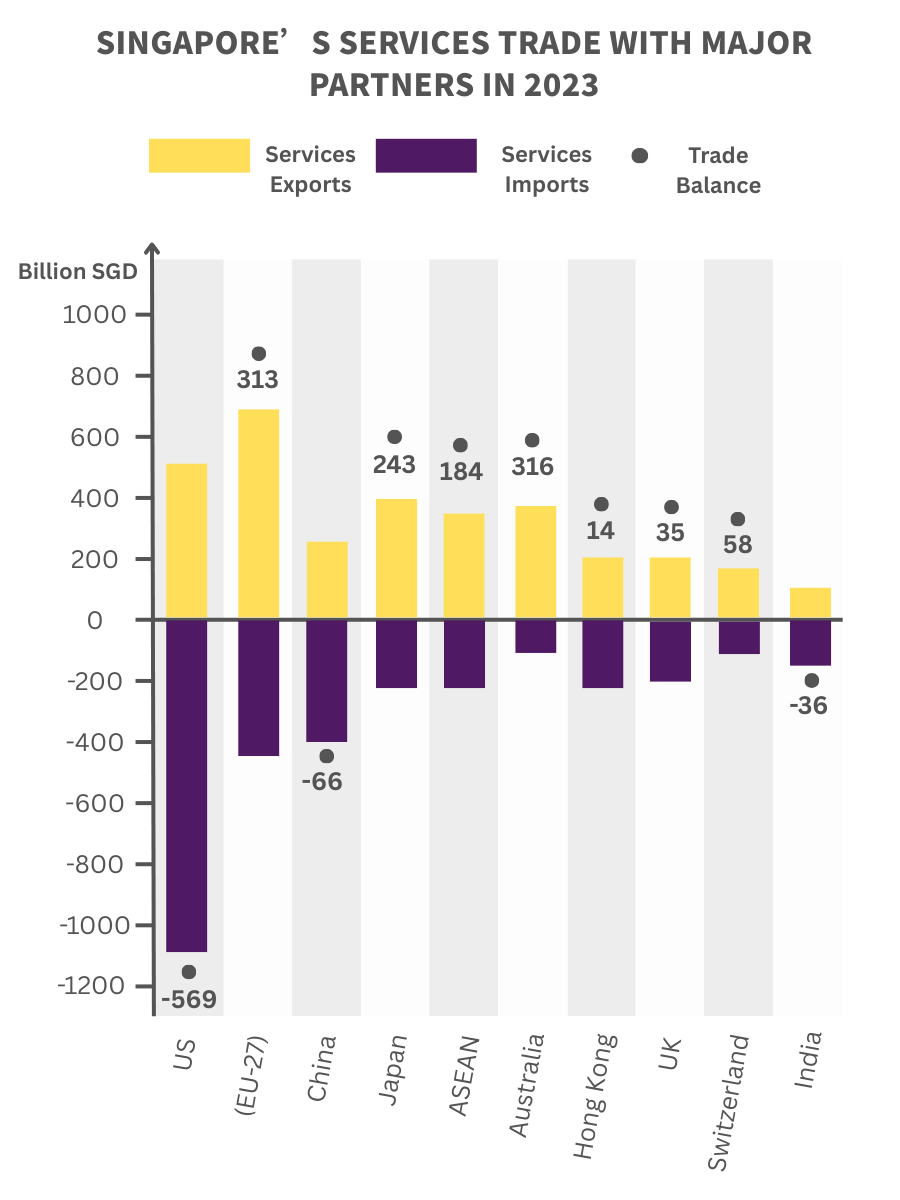

United States remains Singapore’s largest services trade partner in 2023, with bilateral trade reaching S$159.1 billion, nearly triple the 2014 level of S$58.1 billion.

-

European Union (EU-27) follows closely, with trade reaching S$115.7 billion, and has become Singapore’s top services export destination in 2023, accounting for 15.3% of exports—up from 9.7% in 2014.

-

Mainland China surged from S$21.3 billion to S$64.9 billion, surpassing ASEAN to become Singapore’s third-largest services trade partner.

-

Japan climbed from sixth to fourth place, with services trade growing from S$18.1 billion to S$62.2 billion.

Future Outlook: Strengthening Singapore’s Global Services Hub

Looking ahead, the report highlights strong future demand for services, driven by the rise of the regional middle class and global consumption trends. To sustain growth, Singapore will focus on:

-

Enhancing competitiveness in export-oriented services

-

Expanding market access overseas

-

Deepening international trade partnerships

These strategies will position Singapore to capture long-term growth opportunities and solidify its role as a leading global hub for services exports.

Once seen as a supplement to goods trade, services trade has become a strategic pillar of Singapore’s economic future. With continued investments in high-value, knowledge-intensive sectors, Singapore is well-poised to lead in the evolving global services economy.